Calculate paycheck with 401k contribution

In the following boxes youll need to enter. Gross pay This is your gross pay before any deductions for one pay period.

401k Employee Contribution Calculator Soothsawyer

2022 Federal income tax withholding calculation.

. Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. 2022 Federal income tax withholding calculation. Affordable easy payroll integrated.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Robust digital tools data-driven insights. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well.

Retirement Calculators and tools. Get Help Designing Your Plan. So if you elect to save.

Build Your Future With A Firm That Has 85 Years Of Investing Experience. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. A 401 k contribution can be an effective.

NerdWallets 401 k retirement calculator estimates what your 401 k balance will. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will. The earlier you start contributing to a retirement plan the more the power of compound interest may help you save.

Ad Get Help Rolling Over Your Old 401k Account to a Fidelity IRA. Your annual gross salary. Full Service Transparent Pricing.

Pay period This is how often you are paid. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. Subtract 12900 for Married otherwise.

Please note that your 401k plan contributions may be limited to less than 80 of your income. Ad Attract and keep employees with 401k plans. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Strong Retirement Benefits Help You Attract Retain Talent. Retirement Contribution Effects on Your Paycheck Calculator. Affordable easy payroll integrated.

You want to save for retirement and take advantage of your employers match in your 401 k plan but you arent sure you can afford to. Please enter a dollar amount from 1 to 1000000. For 2021 the maximum contribution for this.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. Check with your plan administrator for details. The Roth 401 k allows you to contribute to your 401 k account on an after.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Use our retirement calculator to see how much you might save by the time. That represents an increase in your take home pay compared to what would happen if you contributed the same amount to a taxable account.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. This calculator has been updated to. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

401 k Contribution Calculator. Second multiply your gross income per pay period by the. Seamlessly integrate with 200 payrolls to eliminate burden of processing contributions.

Ad Help Employees Get More Out of Retirement. The 401k contribution calculator exactly as. This calculator uses the latest.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. First divide your annual salary by the number of pay periods per year to calculate your gross income per pay period. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

How frequently you are paid by your employer. A 401k is an employer-sponsored retirement plan that allows you to relegate a percentage of your paycheck into future retirement savings. Small business 401k plans with big benefits.

Schwab Retirement Plan Services. Your expected annual pay increases if any. In the following boxes youll need to enter.

Ad Easy-Setup 401ks For SMBs. Subtract 12900 for Married otherwise. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Penelope makes it simple. Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

Ad Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

401k Contribution Calculator Step By Step Guide With Examples

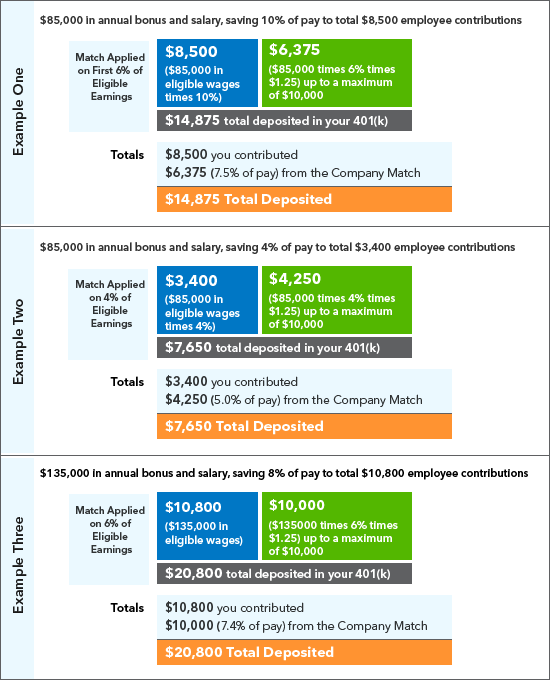

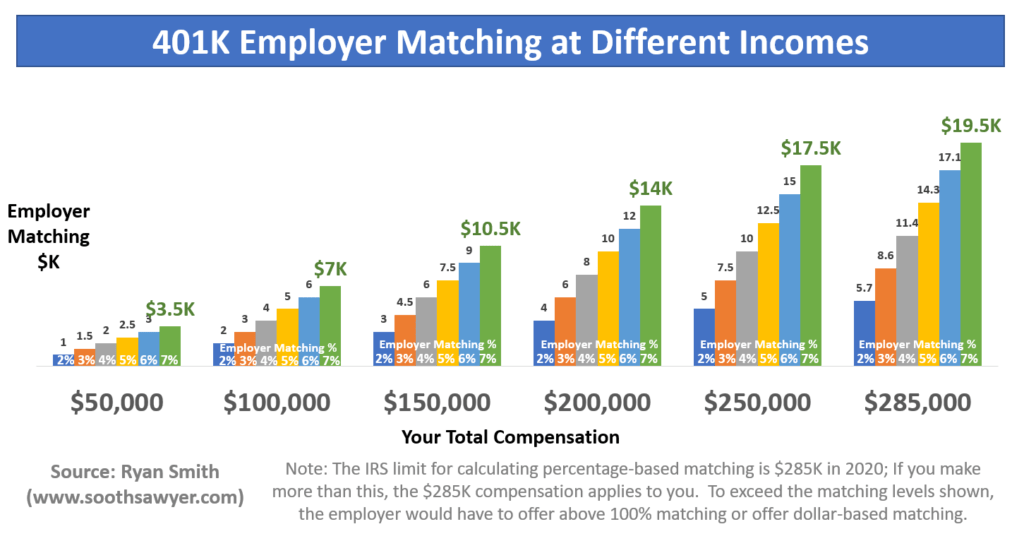

Doing The Math On Your 401 K Match Sep 29 2000

401 K Savings Plan Intuit Benefits U S

401 K Maximum Employee Contribution Limit 2023 22 500

Free 401k Calculator For Excel Calculate Your 401k Savings

Strategies For Contributing The Maximum To Your 401k Each Year

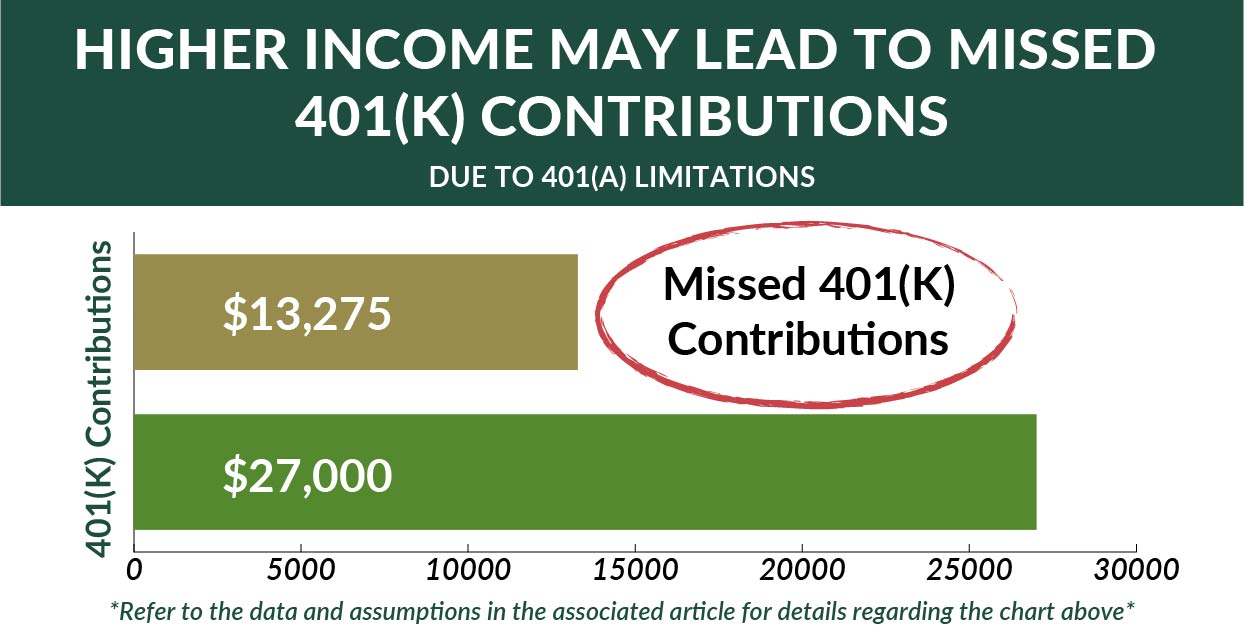

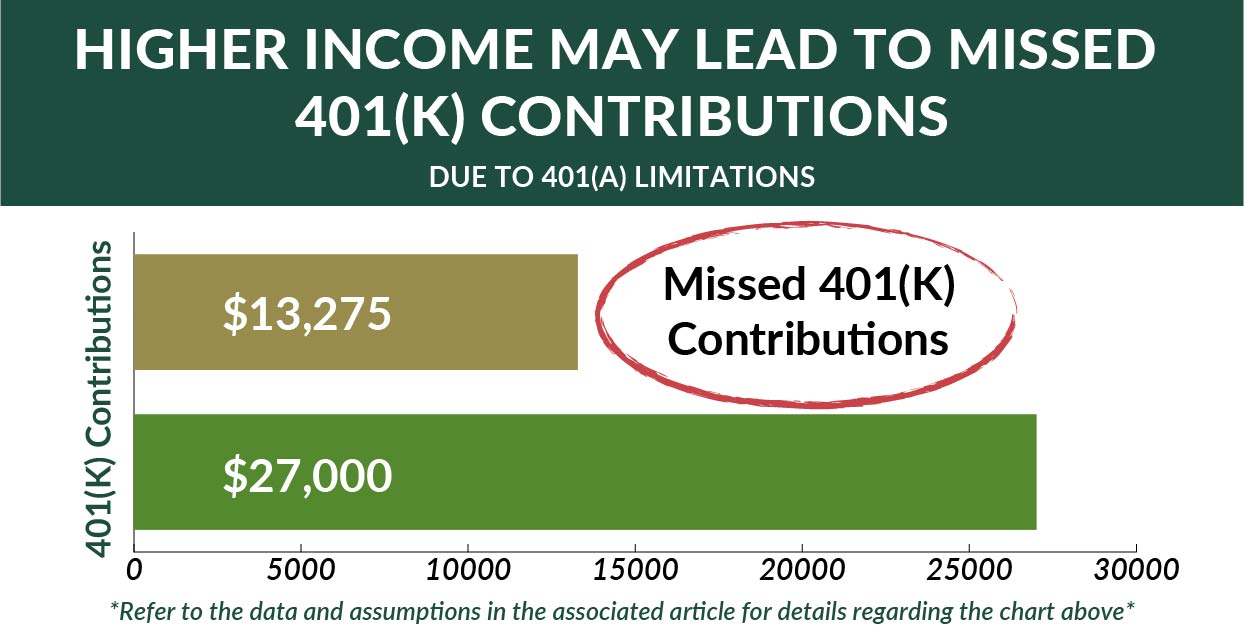

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

Download 401k Calculator Excel Template Exceldatapro

Download 401k Calculator Excel Template Exceldatapro

401 K Plan What Is A 401 K And How Does It Work

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

401k Employee Contribution Calculator Soothsawyer

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

After Tax Contributions 2021 Blakely Walters

Solo 401k Contribution Limits And Types

Do 401k Contribution Limits Rise Every Year Quora

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer